arizona estate tax laws

Laws 1979 Chapter 212 repealed the Estate Tax Act imposed a new Estate Tax and levied a tax on generation-skipping transfers of property. In Arizona as in other states ones estate is inherited by friends relatives or other beneficiaries according to the details in the written will.

Is There An Inheritance Tax In Arizona

We begin the class by exploring unique aspects of.

. Form Year Form Published. Proposing an amendment to the Constitution of Arizona. To solve this problem apply online by fax or via mail for an employer identification number EIN to represent the estate on official tax paperwork.

The State of Arizonas individual income tax filing season has launched and is now accepting electronically filed 2021 income tax returns. Statutes are laws passed by the Arizona Legislature. Tax Table X Estate Trust.

During this time they must also publish a notice in a. And other matters pertaining to ones home or residence. In 2001 Congress passed a law that raised the amount that could pass without tax increasing it in steps from 675000 in 2001 to 35 million in 2009.

Relationships between landlords and tenants. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Under the new laws the Arizona Estate Tax was.

Federal law eliminated the state death tax credit effective. Chapter 12 - Property. Explore Arizona community property trusts wills powers of attorney estate gift taxes and how title to your assets affects your estate plans.

Laws 1979 Chapter 212 repealed the Estate Tax Act imposed a new Estate Tax and levied a tax on generation-skipping transfers of property. The personal representative has up to 30 days to notify inheritors once probate has been opened. Before filing ensure you have all documentation.

Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the. Dying With a Will in Arizona. This gift can be made to an unlimited number of people and there is no requirement to file a tax return.

This online version of the Arizona Revised Statutes is primarily maintained for legislative drafting purposes and reflects the version of law that is effective on January 1st of the year following. Federal gift laws allow any person to gift away 15000 annually. Then in 2010 the.

In the absence of a will state probate court decides. State revenues are comprised of property taxes sales tax and certain taxes on businesses. The minimum time is around five months.

Download 812 KB 01012022. Federal state and local governments all collect taxes in a variety of ways. Property and real estate law includes homestead protection from creditors.

Proposition 130 Proposed amendment to the constitution by the legislature relating to property tax exemptions. Chapter 11 - Property Tax. The majority of statutes relating to property tax are referenced in Title 42 Taxation.

Under the new laws the Arizona Estate Tax was. Fiduciary and Estate Tax.

Arizona Vs Nevada Which State Is More Retirement Friendly

Is There An Inheritance Tax In Arizona

5 Things You Should Know About Probate Law In Arizona

State Death Tax Chart Resources The American College Of Trust And Estate Counsel

Arizona Estate Tax Everything You Need To Know Smartasset

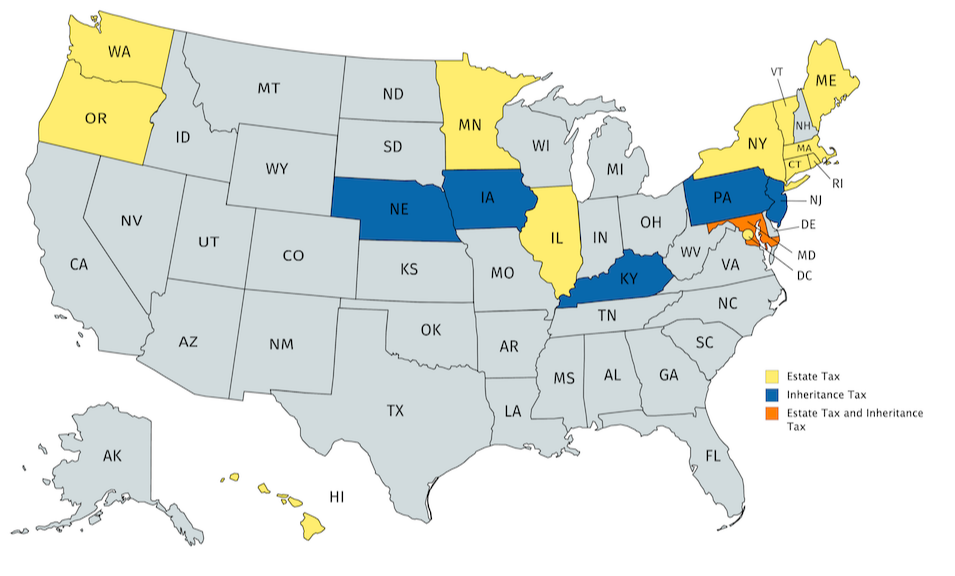

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Living Trust Phoenix Arizona Mobile Estate Taxes

State Estate And Inheritance Tax Treatment Of 529 Plans

Do You Report Income Tax On An Inheritance In Arizona Budgeting Money The Nest

Is There An Inheritance Tax In Arizona

Is There An Inheritance Tax In Arizona

Free Arizona Last Will And Testament Template Pdf Word Eforms

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Do You Report Income Tax On An Inheritance In Arizona Budgeting Money The Nest

Arizona Estate Tax The 1 Way To Avoid